Projects Help and User Guide

Sicon Projects Help and User Guide will take you through the features and settings for the Sicon Projects module for Sage 200.

Search the page by pressing Ctrl + F (windows) or CMD +F (Mac) on your keyboard.

Back to all user guidesProduct overview

Back to Sicon Manufacturing Help & User Guide Summary PageMaintained for version 201x.20.0.0 and upwards

The Sicon Projects Help and User Guide will take you through the features and settings for the Sicon Projects module for Sage 200.

This module is fully integrated with the Sage 200 POP, SOP, Stock, Purchase, Sales and Nominal Ledger for the purpose of recording costs and revenue against individual projects.

It looks like any other Sage 200 module, making it easy to use for anyone already familiar with the Sage 200 environment.

Reports are available within the Sage 200 report designer so they can be amended to suit specific business requirements.

1. Sage Transaction Project Links

Projects are linked to the following standard Sage transactions for the purpose of cost and revenue recording.

- Purchase Orders/Returns

- Sales Orders/Returns

- Stock Issues/Returns/Allocations

- Purchase Ledger Invoices/Credits

- Sales Ledger Invoices/Credits

- Nominal Journals

- Nominal Payments/Receipts

- Nominal Prepayments

- Nominal Accruals

Nominal transactions from any of these sources are linked to Sicon Projects via the id number of the project transaction being added to the narrative of the nominal posting. This is vital for the purposes of reconciling nominal postings back to Sicon Project transactions.

Project Number and Project Header are viewable against the nominal transaction in the Nominal Ledger Transaction Enquiry screen for both Current Transactions and Historical Transactions.

1.1. Purchase Orders/Returns

When entering a Purchase Order (or Return) the user may select the appropriate project and project Header for each Standard Item or Free Text Line. Alternatively, you can select the project and project Header on the Order Details tab itself, and this will then act as a default for all lines on the purchase order (but could still be overridden with a different project and project header if required).

If the option to include completed projects is enabled in Project Settings, then above the presented list of projects will be a check box to include the completed ones.

If project structures are enabled within the settings, and this transaction is being linked to a phase/stage/activity, then this information is viewable by clicking on the box between the project and project header fields which will cause a box to appear detailing these selections. If relevant to an activity, then you can just choose this and then the relevant Phase and Stage values will be selected automatically.

When selecting the project and project header, the nominal account will then default to the account specified for that cost header on that project, or the nominal account specified against the cost header if there hasn’t been one specified on the project.

Once a project has been selected, you can click the box ![]() to the right of the project header to open up the Sicon Projects Enquiry window for that project. This box is not activated on lines linked to the N/A project.

to the right of the project header to open up the Sicon Projects Enquiry window for that project. This box is not activated on lines linked to the N/A project.

The transaction date on the Sicon Projects transaction will be requested delivery date from the line, or from the purchase order header if not populated on the line. For this reason, you must enter a Requested Delivery Date on the order header, or you will receive a message advising you to enter one before being able to save the order.

![]()

Any landed costs recorded against the purchase order line are also included in the cost figure attributed to the project.

Transactions from foreign currency purchase orders are stored as the base currency along with the exchange rate of the transaction. This allows you to switch the Project Enquiry view to show any currency stored in Sage.

It is also possible to select site addresses specified on a project as the delivery address on the purchase order as long as you have selected the project on the Order Details tab. On the Delivery & Invoicing tab of the order, if you click on the highlighted icon to the right of the Postal name field then the address entered on the Address tab of the project will pull through onto the order.

![]()

Sicon Project Purchase Order/Return Status

As a default, the Sicon Projects system will automatically move purchase order items from ‘committed’ to ‘actual’ at the point of invoice.

However, the Update POP actuals on setting can be changed in the Settings (POP Tab), to allow items to be moved to ‘actual’ at the time of goods received.

1.2. Matching Invoices to Purchase Orders

In order to correctly deal with supplier invoices arriving with unexpected additional costs (i.e. carriage), there are some restrictions to how purchase invoice information can be recorded against purchase orders with the Sicon Projects integration enabled across Sage200.

There are three scenarios that will be considered here: –

- Invoice arrives and matches up to multiple lines on the purchase order

- Invoice arrives and has extra charges, or is for a higher/lower value than the purchase order lines

- Invoice arrives and purchase order is linked to the N/A project

- Invoice Matching when values agree

- When recording the supplier invoice against the order, you will find that the Goods Value and VAT Value fields cannot be edited (although the Discounted Unit Price can). Similarly, when you get to the second screen of the Record Invoice process, you will notice that the nominal information can only be edited on the Sicon Projects Analysis tab. At this point you are not able to change the Project Number or the Project Header as this would lead to issues with the purchasing commitment not matching correctly to the actual purchasing costs. You can edit the nominal code if at this point it becomes apparent that the PO has been coded incorrectly. But you can’t change the values in the Goods Value column, so will get nominal postings that match your PO lines in value.

Saving and posting the invoice will generate zero value purchase invoice transactions on the project that contain the invoice details. These are hidden by default, but can be viewed by unticking the Hide ‘Zero’ Transactions checkbox in the Sicon Projects enquiry screen.

- When recording the supplier invoice against the order, you will find that the Goods Value and VAT Value fields cannot be edited (although the Discounted Unit Price can). Similarly, when you get to the second screen of the Record Invoice process, you will notice that the nominal information can only be edited on the Sicon Projects Analysis tab. At this point you are not able to change the Project Number or the Project Header as this would lead to issues with the purchasing commitment not matching correctly to the actual purchasing costs. You can edit the nominal code if at this point it becomes apparent that the PO has been coded incorrectly. But you can’t change the values in the Goods Value column, so will get nominal postings that match your PO lines in value.

- Invoice Differs from Purchase Order Values:

- If the invoice value differs from the purchase order value, then in the first screen that appears you will not be able to edit the Goods Value or VAT Value fields. You can edit the Discounted Unit Price to reflect the difference between the invoice and purchase order price. You will receive a warning message advising of variance in price from the original order line if you adjust the Discounted Unit Price that gives you the option of clicking Yes or No to continue.

Then when you get through to the second screen, you can enter additional lines onto the Sicon Projects Analysis tab to match the total invoice value that you’ve entered in the Goods Value field. The example image below shows a common example where carriage has been added. These additional lines can also be entered as a negative value to handle situations where the invoice is less than the value on the purchase order. If you have entered a different invoice value to the line on the previous screen and not adjusted the discounted unit value to match them up again, then an additional line will be added automatically for the difference.

- If the invoice value differs from the purchase order value, then in the first screen that appears you will not be able to edit the Goods Value or VAT Value fields. You can edit the Discounted Unit Price to reflect the difference between the invoice and purchase order price. You will receive a warning message advising of variance in price from the original order line if you adjust the Discounted Unit Price that gives you the option of clicking Yes or No to continue.

- Purchase Order linked to N/A project:

- The fundamental difference with Purchase Order lines that are linked to the N/A project, is that when the invoice is being recorded, you can still edit the project information for that invoice. So, it’s possible to select which project (or projects) the invoice is relevant for, and to split the invoice value between project headers if applicable.

- Invoice Matching when values agree

![]()

1.3. Sales Orders/Returns

When entering a Sales Order (or Return) the user may select the appropriate Project and Project Header (and Phase/Stage/Activity if enabled) for each Standard Item or Free Text line. You can also select Project and Project Header for Additional Charge lines. Alternatively, you can select the Project and Project Header on the Order Details tab itself, and this will then act as a default for all lines on the sales order (but could still be overridden with a different project or project header if required).

If project structures are enabled within Sicon Project settings, and this transaction is being linked to a phase/stage/activity, then this information is viewable by clicking on the box between the project and project header fields which will cause a box to appear detailing these selections. If relevant to an activity, then you can just choose this and then the relevant Phase and Stage values will be selected automatically.

If the option to include completed projects is enabled in Sicon Projects Settings, then above the presented list of projects will be a check box to include the completed ones.

When selecting the project and project header, the nominal account will then default to the account specified for that project header on that project, or the nominal account specified against the project header if there hasn’t been one specified on the project.

Once a project has been selected, you can click the box ![]() to the right of the project header field to open up the Sicon Projects Enquiry window for that project. This box is not activated on lines linked to the N/A projects.

to the right of the project header field to open up the Sicon Projects Enquiry window for that project. This box is not activated on lines linked to the N/A projects.

The transaction date on the project transaction will be the promised delivery date from the line, or from the sales order header if not populated on the line.

![]()

Sicon Projects Sales Order/Return Status

As a default, the Sicon Projects system will automatically move sales order items from ‘committed’ to ‘actual’ when the item is confirmed as despatched.

However, settings can be changed in the Sicon Projects Settings screen (SOP Tab), to allow items to be moved to ‘actual’ when a sales invoice is posted. Regardless of this setting, additional charges always get moved from ‘committed’ to ‘actual’ when the invoice is posted, as they are never despatched in Sage.

When processing Sales Orders for ‘stock’ items it is possible to automatically post a ‘cost of sale’ stock transaction to the Sicon Projects system. To allow this the ‘Automatically write cost of sales to project’ setting should be selected in the Sicon Projects Settings screen.

Note that nominal postings will be split for each line when the SOP invoice is posted, so that it is possible to maintain a one to one link between each project transaction (the line on the sales order) and the nominal posting. This doesn’t happen if the project that the transactions are linked to is the N/A project, in which case the regular Sage nominal postings happen.

It’s possible to also link SOP Quotation lines to projects, and this information is transferred onto the Sales Order when it’s generated from that Quotation. It’s also possible to store project information on SOP templates, and this is replicated onto any new orders created with those templates.

1.4. Stock Internal Issues/Returns/Allocations

When entering a Stock Internal Issue/Return/Allocation the user may select the appropriate Project and Project Header (and Phase/Stage/Activity if enabled). The ‘Include completed projects” tick-box may be checked to show ‘Completed’ projects within the drop-down list.

When selecting the project and project header, the issues nominal account on the Analysis tab will then default to the account specified for that job header on that project, or the nominal account specified against the project header if there hasn’t been one specified on the project.

It is possible to configure the system to automatically write the selected Project Number to the stock transaction ‘reference’ or ‘second reference’ via the use of the ‘Automatically write stock project number to’ setting maintained in the Sicon Project Settings screen, see Stock Tab.

![]()

Allocations would show in the project enquiry screen as committed cost transactions, while issues are actual cost transactions.

Against each Stock code, there is the opportunity to set default project headers on a Project Costing tab accessed via Amend Stock Item Details.

![]()

The types where you can specify a default project header are: –

COS: Indicating that when this item is sold, if you have enabled COS postings (via the SOP Tab in Project Costing Settings,), then the Cost of Sales transaction that appears in the stock window within Project Enquiry will use this project header.

Issues: When you are issuing stock to a project via the Internal Issue screen, use this project header for the cost of the stock issue transaction.

SOP: Indicates which project header this item should default to when selling it on a sales order for the revenue transaction.

POP: Indicates which project header this item should default to when buying it on a purchase order for the cost transaction.

Post COS in project costing as zero: If you never want to see a Cost of Sale posting for this stock code on the project , then check this box.

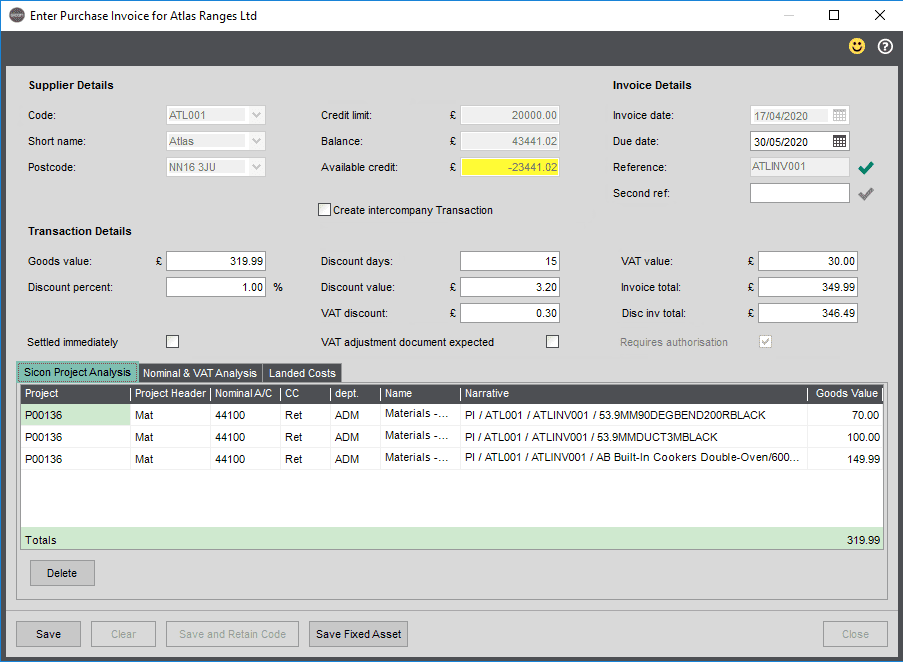

1.5. Purchase/Sales Ledger Invoices/Credits

An extra tab (Project Costing Analysis) is added to the transaction entry screen which enables you to split the value of the invoice across multiple projects within the same screen.

![]()

When selecting the project and project header, the nominal account will then default to the account specified for that cost header on that project, or the nominal account specified against the project header if there hasn’t been one specified on the project. Only the VAT Analysis information displayed on the Nominal & VAT Analysis tab can be edited.

When viewing the transactions in either the Purchaser Ledger Supplier Transaction Enquiry screen, or the Sales Ledger Customer Transaction Enquiry screen, there is a Project Costing tab available next to the Analysis tab at the bottom that will display the project costing information recorded against that transaction. There is also a button below this that will open the Sicon Projects Enquiry screen for the relevant transaction.

Any detail from the purchase order line is included in the Nominal Narrative of the Expense Nominal Account posting.

![]()

Extra information can be stored against each line on the Purchase / Sales Ledger Invoice or Credit Note using the Spare Fields within Project Costing. Turning this on in the Sicon Projects setting prompts with an extra screen upon save allowing you to record up to 5 Text Fields, 5 Number Fields and 5 Date Fields against each line in an editable grid.

![]()

Selecting the ‘Set Spare Fields’ allows you to enter the spare fields on an in a different format.

![]()

These spare fields recorded against Purchase Transactions can also be seen in the All Costs tab on the Sicon Projects Enquiry screen.

1.6. Nominal Journal Entry

![]()

A project number and project header (and Phase/Stage/Activity if enabled) can be added to each journal transaction line. These will post through to the Sicon Projects module as Journal transactions.

When selecting the project and project header on the journal lines, the nominal account will then default to the account specified for that cost header on that project if one has been specified.

If a reversing journal is selected, then the same project and project header selections will be applied to the reversing entry.

If the journal is held before posting, the project information remains with the held journal and will post to the project when the journal is released from hold.

1.7. Nominal Payments/Receipts

Nominal Taxable Receipt, Nominal Taxable Payment, Nominal Non-Taxable Receipt, Nominal Non-Taxable Payment

![]()

A project number and project header (and Phase/Stage/Activity if enabled) can be added to a nominal taxable receipt (shown), nominal taxable payment, nominal non-taxable receipt and nominal non-taxable payment. This will post through to the Sicon Projects module as Nominal Transactions.

1.8. Prepayments

![]()

A project number and project header (and Phase/Stage/Activity if enabled) can be added to a nominal prepayment. This will post through to the Sicon Projects module as a Nominal Transaction.

1.9. Nominal Accruals

![]()

A project number and project header (and Phase/Stage/Activity if enabled) can be added to a nominal prepayment. This will post through to the Sicon Projects module as N.Receipt.

2. Projects Lists

2.1. Project List

Only available for Sage 200 2015 and later, these access the Project Costing List views in the Work area. Two Project Costing lists are available – A Basic list comprised of a few columns (for increased speed), and a more detailed Advanced list with some calculated columns. Also available is a Purchase Order List with projects within the Sage Purchase Order Processing Module, which is the same as the standard Purchase Order List but with an additional column containing the Project Number(s).

The functionality here works in the same way as other list views in Sage200, so filters can be created and saved, columns can be added/removed, you can search for projects in the list, you can use the action icons above the list to access specific project costing screens, send the list to an Excel spreadsheet etc. If you double click on a project number, then it will open the Project Enquiry, (see section 5.1 for further details) screen.

For the Basic list, the columns appearing by default are: –

- Project Number

- Description

- Status

- Project created Date

- Start Date

- Planned Completion Date

- % Completed

- Actual Completed Date

- Manager

- Customer

- The seven analysis codes available on the Project

For the Advanced list, the columns appearing by default are: –

- Project Number

- Description

- Status

- Project created Date

- % Completed

- Manager

- Customer

- Budget Revenue

- Committed Revenue

- Actual Revenue

- Total Revenue

- Budget Cost

- Committed Cost

- Actual Cost

- Total Cost

- Budget Profit

- Actual Profit

- Revenue Variance (highlighted green or red for positive/negative)

- Cost Variance (highlighted green or red for positive/negative)

- Actual Completed

- Total Profitability %

- Revised Revenue – derived from Revenue to Complete

- Last Revised Revenue

- Revised Cost – derived from Cost to Complete

- Last Revised Cost

- The seven analysis codes available on the project

2.2. Current Transactions List (With Projects)

Current Transaction List can be found under Nominal Ledger.

![]()

It contains the Nominal Posting Details for each current transaction.

2.3. Purchase Order List (With Projects)

This is found under Purchase Order Processing.

![]()

For the Purchase Order List (With Projects), the columns appearing by default are:-

- No

- Type

- Date

- Name

- Amount

- Status

- Project Numbers

![]()

2.4. Sales Order List (With Projects)

Sales Orders List (With Projects) can be found under Sales Order Processing

For the Sales Order List (With Projects), the columns appearing by default are:

- No

- Type

- Date

- Name

- Amount

- Status

- Project Numbers

![]()

3. Maintenance Menu | New Project

The maintenance menu allows access to the various maintenance functions for the Sicon Projects module.

Select New Project from the menu to create a new project . This page is highly configurable. See Sicon Projects Settings for further details.

Alongside the Save, Delete, Cancel and Maintain Budget buttons is a Charge Out Rate button that is always selectable regardless of the tab that you are on. Specific charge out rates can be defined for this particular Project. These will override rates specified against each employee/resource. You can also select a default labour/resource charge-out rate. These rates will only be used in this project if you check the box ‘Use Project Charge Rates’, otherwise the rates will be taken from the relevant employee records.

![]()

The Maintain Budget button gives direct access to that screen for this project

3.1. General Tab

![]()

The Project number field is only editable if you have not enabled ‘Automatically generate next project number’ in the Sicon Project Settings.

The Status field defaults to ‘Live’.

The Chargeable Type field has options in the drop down to reflect what elements should be invoiced to the customer on this project. This will be utilised by the Generate Billing Transactions routine.

The Description field is a text field (max of 256 characters).

The Customer name field enables you to connect the project to a sales ledger account. This field can also accept free text, but by clicking the square button (containing the three dots) at the end of the customer name field you are then prompted to search for a customer account in the usual Sage way.

The Currency field allows you to select a currency that should be used to display the values in the Project Enquiry screen. If you wish to leave the enquiry screen working in your system base currency, then you can leave this field empty.

The Project Manager field allows you to select from defined employees that have the ‘Project Manager’ checkbox enabled on their employee record. See ‘Maintain Employees’ for further information.

The Project Created date field will default to the current date when creating a new project.

The next radio button gives you a choice between displaying the rest of the fields in the screenshot (Analysis view), and displaying additional fields from the sales ledger account (Customer view).

![]()

The button containing the three dots will take you to the Account Enquiry screen for that sales ledger account, while the Amend Customer A/C button takes you to the Amend Customer Details screen, if you have access to this in your role.

The three date fields (Start date/Planned completion date/Actual completion date) are for information and reporting purposes only. The Actual Completion date will be updated automatically when the project is marked as completed.

Percentage complete is a decimal field that is linked to the Project Status. Changing the Project Status to ‘Complete’ will automatically set this field to 100, and vice versa. If you need to re-open a completed project , then you could set this field to any value less than 100. Other values in this field are for information and reporting purposes only.

Markup percentage is a decimal field that is utilised by the Generate Billing Transactions routine.

PO Number is a regular text field for the customer order number.

The seven fields to the right are the Analysis fields. All of these can be renamed in the Analysis Codes screen within the Maintenance menu – Analysis 1 having already been renamed to ‘Project Type’ in the previous screenshot.

3.2. Notes Tab

![]()

This tab allows entry and amendment of multi-line text notes against the project. If there are any notes on this tab, then an asterisk will appear against the tab title.

3.3. Address Tab

![]()

This tab enables you to view the default Delivery/Site Address for the project. It also allows you to maintain a list of Delivery Addresses that are available to the project. With this information recorded, you can then select one of these addresses when creating purchase orders linked to projects, see Purchase Orders/Returns.

Clicking on the Maintain Project Addresses, prompts with a list of Addresses that have been added to the account.

![]()

Click on the Add button allows you to add an Address to the list. If the project is linked to a customer account, then an icon to the right of the Location field allows you to search for delivery addresses linked to that account in Sales Order Processing. You can also use this for a free text entry.

![]()

Below the address fields, you can record a site contact, their contact details, and a box for Site Notes exists.

A list of Address available on the Project is demonstrated below:

![]()

3.4. Memo Tab

![]()

This tab enables you to enter memos in a similar fashion to entering them in standard Sage. The Show Detail checkbox enables you to see the full memo text for a highlighted memo.

3.5. Phases/Stages Tab

This tab only appears if you have enabled project phases & stages within the Sicon Projects settings screen (within the Projects tab). It enables you to define a structure for this project comprised of three levels – Phases, Stages and Activities. The expectation is that you will have an activity defined against each phase/stage combination, as activities are the level where various items are stored.

So, to clarify, if you are using Phases and/or Stages, you must enter at least one entry at all three levels – a Phase, a Stage and an Activity.

It is also possible via settings within Sicon Project settings to only enable activities, in which case you can add activities to the project without requiring phases or stages above them. It is also possible to add Activities (only) to a Project with Phases, Stages and Activities enabled.

![]()

A project needs to be saved before you can enter stages/phases/activities against it.

Note that it’s not possible to copy a structure from another project directly into a new project, but you can use the Import Project Phase, Stage & Activities option in the Import menu to import them from a csv file. If you want to re-use a similar structure across projects, then it would be worth using the templates functionality and creating the structures against your templates.

It’s possible to add free-text phases, stages and activities to each project, avoiding the need for these to be defined via the maintenance menu first.

![]()

In the structure, the different types of elements can be identified via the Text Highlight colour behind the line.

Phases are displayed with white text in a grey background

Stages are added to Phases, and are displayed with black text in a lighter grey background

Activities are added to Stages (if enabled, otherwise they can be added directly to the project), and are displayed with black text in a white background

Other Items are added to Activities, and are displayed with black text in a pale green background

The Add/Edit buttons change depending upon the line you have highlighted. So, if you have the Project highlighted at the top of the structure, then Add button reads Add Phase. If you are clicked onto a Phase already, then it will become Add Stage. Similarly, if you are clicked onto a Stage, then it will become Add Activity.

If you are clicked onto an activity line, then the Add button changes to Add Item. There are four item types that can be added to an activity: –

- Operation

- Planned Purchase (detailed in Planned Purchases section of this help and user guide)

- Plant Hire (detailed in Hired in Plant section of this help and user guide)

- Task

While clicked onto an activity line on this screen, additional buttons appear at the bottom for Maintain Planned Purchases and Process Planned Purchases, and are used for existing planned purchases records (use the Add Item button to create a new one). Planned Purchases can only be set against an activity, and are detailed in their own section in this help and user guide.

![]()

When adding phases, you can either select the phase from the drop-down list or enter a free text description. The selection list for both the Phase field and the Status field is maintained via the Maintain Phases, Stages & Activities screen. If you change the Status to Completed, then the % Complete field will be automatically set to 100.

The options displayed in the Project Manager dropdown are restricted to employees who have the project manager checkbox ticked in the Maintain Employees screen.

The five analysis codes available here are free text fields, and it’s not possible to rename them in the same way that you can for the analysis codes on the project.

The status can be updated at any of these levels using the Status drop down menu. If you change the status of an item that has stages/activities within it, then you’ll be prompted as to whether you want to update the status on those to be the same.

When adding Stages, the screen displayed is the same as that for Phases, but without the Project Manager option as this only exists at the Phase level.

![]()

When adding activities, the fields are the same as for Phases/Stages (without the Project Manager field), apart from the Quote Price field which only exists at the Activity level. This field allows you to record a quoted cost price for the activity, which can then be picked up by a report.

![]()

Operations are items that can be added to activities, and allow you to record more specific information about that operation. The Operations will be given a unique ID number upon saving, which is reset for each different project. So, the first operation on a project will always be OP00000001.

The fields in here enable you to record any 3rd party reference number, the start date (and time), a description of the operation, a quantity completed (if applicable), percentage completed (if applicable) and who the operation is assigned to (a free text field).

On the Operation Time tab, you can indicate which employee team will be handling this operation, which project header is applicable for the costs, a description, the number of hours, the unit cost value and the manning level. These last three items are multiplied together to arrive at the total cost of the operation, a field which is also displayed in the top half of this window. In a similar fashion, any unit selling price is also multiplied by the number of hours and the manning level to arrive at a total selling price for the operation. On a project, this is for information purposes only, while doing the same on an estimate would help generate your revenue budget.

On the Stock Items tab you can add multiple stock items onto this operation.

![]()

Against each stock item entry, you can select the relevant project header, choose the stock code (which will then pull through the description, unit value (the average cost price) and the unit selling price (from the standard price band). You then enter a quantity (which will generate the total cost and total selling price) and choose which warehouse you want to issue that stock from.

Once you have added stock to the operation, you can then allocate and issue the stock, which will then post the costs onto the project (as a committed cost during the allocation, and an actual cost during the issue). You can also do this in the Manage Operation Materials screen that can display all of the stock required across all operations on a project, and allow you to allocate and issue the stock to them en masse.

![]()

The final item that you can add are tasks. These can be assigned to users who are defined in our separate Task and Contacts module, which is also where you could define any custom attribute fields that would appear on the Attributes tab. Any tasks can be reviewed within the Manage Project Tasks screen in the Project Management menu.

![]()

Multiple memos can be recorded against each task. A task can be marked as completed (via the checkbox near the top of the window), and a follow up task can be generated via the Create Follow Up button.

3.6. Billing Profile Tab

![]()

This tab is relevant for customers using the Generate Billing Transactions option within the Transaction Entry Menu, generally when they have a fixed price agreement for that element of the project. It allows you to define fixed billing prices against a project, and then when you are generating the billing transactions, you will be prompted with the option of assigning those transactions against this billing profile. If you do so, the fixed cost price defined on the profile will override the individual transaction charges on the generated sales order, and the line description will be set to the billing profile description.

The expiry date of a billing profile will be highlighted in red if it is a date in the past.

A billing profile will have a status of ‘Open’ upon creation. Once a billing profile has been selected when generating billing transactions on the relevant project, then its status changes to Billed to prevent it being selected again.

3.7. Attachments Tab

![]()

This tab enables you to attach documents to a project, in a similar fashion to other attachment functionality in Sage. You can add a file – which places a copy of the file into a subfolder (JCATTACH) of the company attachment folder specified in the company settings in Sage 200 System Admin. Alternatively you can add a shortcut to a folder on the network, or else a link to a file on the network that will not be copied into the attachment folder.

3.8. Project Headers Tab

![]()

With this tab, you can choose whether all project headers are applicable for this project (which they are by default). If you uncheck the box marked Mark all project headers available for this project, then you can then use the checkboxes in the Available column to make selected project headers selectable for transactions on this project , or not.

This tab also enables you to specify nominal code overrides, accrual and deferred overrides for each project header for this project. These nominal code selections will override any nominal codes specified in the Maintain Project Headers screen when transactions are entered against this project. You can also enter a markup% against each project header for this project, which will then be added to the charge out rate of that transaction if you are raising invoices via the Generate Billing Transactions option. This will also override the markup% specified against the project header in Maintain Project Headers when used on this project.

3.9. Configuration Tab

![]()

This tab allows you to define default cost centres and departments that will then be applied to the nominal coding of transactions that are linked to this project. You can use the check boxes to indicate which ones are applicable, so it is possible to have a default department without a default cost centre for example.

There is also a tick box to exclude the project from desktop lists.

3.10. RAMS Tab

![]()

This tab allows you to enter any relevant Risk Assessment and Method statements that pertain to this project. This information could then be picked up by any reports before giving that to the relevant employee working on the project.

The RAMS statements that can be added to this tab are maintained via the Risk Assessment and Method Statements screen within the Maintenance menu.

3.11. Customs Tab

![]()

In this screenshot, the two tabs labelled as ‘Project Fields 1’, ‘Project Fields 2’ and ‘Transport’ are examples of custom tabs that can been added using the Maintain Custom Tabs screen in the Maintenance menu folder within Sicon Projects. You can create multiple custom tabs in here, and then there are 140 fields available that can be customised to be included on these tabs, via the Define Custom Fields screen.

3.12. Construction Tab

![]()

This tab only appears when you have the Sicon Construction module installed and configured for your Sage role. Changing dates here in will update all of the existing retentions on the project. Please see the Construction documentation for further information.

3.13. Variations Tab

![]()

This tab enables you to enter variation details, with a date, customer PO number, additional expected cost price (if you wish to report this against your budgets updated against this variation), status and percentage completed. Then when amending existing budgets against your project headers, you can select the relevant variation that the budget relates to. Note that variations only relate to updating budgets, transactions entered against a project are not linked to the variations themselves.

4. Maintenance Menu | Amend Project

The Amend Project screen is used to maintain details of each project already created within Sicon Projects.

![]()

The tabs and fields displayed in here are the same as those described in the New Project section, so please refer to the documentation for that section.

5. Maintenance Menu | Maintain Project Headers

Project Headers are used to analyse different types of transactions associated with projects.

Every transaction posted to a project must have a related project header, although the N/A project header is available as a default. The code and description will be shown in drop-down lists whenever the user is required to select a project header.

It is not possible to delete project headers that are in use or have been used.

![]()

Code: The project header code as you want it to be displayed on reports and in the various screens throughout Sage where you select a project and project header. Once you have saved a project header code, it cannot be changed on a later edit.

Custom Type: (optional) Can contain an alphanumeric code which can be used during reporting.

Report Order: The order may be used to specify the sequence of transactions on certain reports. For example, transactions related to a project header configured with report order ‘1’ will appear above those with report order ‘2’ or ‘3’, etc.

Project header is inactive: If you have a project header that you do not want to use going forward, but cannot be deleted due to it being used previously, then you can mark it as inactive. You can hide Project Headers marked as inactive from this Window, using the ‘Hide Inactive’ button. Inactive Projects are also marked in red

Description: Unlike the code, the project header description can be edited once saved.

Header Type: Select whether the project header is a cost or revenue. This has an effect on reports, and also which project headers are available for selection in certain screens.

Default percentage markup: Used to calculate charge-out prices and may be over-ridden on a project by project basis.

Project header type: You can specify which project item type is relevant for this project header. These are defined in the Maintain Project Header Types screen.

Default Rate: You can specify a default cost rate that will be used against this project header, these are setup within the Project Costing settings.

Default Nominal A/C: A specific default nominal can be defined for each Project Header, which will then be selected as the nominal code when entering a transaction with this project header. This default nominal a/c would be overridden by any nominal codes specified against project headers on that project.

Accrual Nominal A/C: A specific default nominal can be defined for each Project Header, which will then be used in the Accrual Journal for the Cost at Completion Period End Routine.

Deferred Nominal A/C: A specific default nominal can be defined for each Project Header, which will then be used in the Deferral Journal for the Revenue at Completion Period End Routine.

6. Maintenance Menu | Project Header Types

This screen allows you to maintain a list of project header types that are then available when maintaining project headers in the maintain project headers screen.

![]()

Each of these need to be matched up to a WAP Item Type of either ‘E’ for Expenses, ‘T’ for Time, ‘P’ for Purchase, ‘S’ for Sale or can be left blank. These can have multiple item WAP types, you need to separate them with a comma and then tab across before saving. E.g. P,T so then Project Headers under this project header type would be visible on requisitions and timesheets.

The Project Group dropdown lets you select from the following options: – Labour, Materials, Plant Subcontract, Overheads/Other and Revenue. This is relevant for the Project Summary tab in Project Enquiry, and controls in which column in that screen the transaction totals will appear

It is not possible to delete Project Header Types if they are in use.

7. Maintenance Menu | Maintain Employees

This screen allows you to enter and maintain employee records. You can enter various cost rates, and then book transactions against any of these to reflect their costs on the project. This is generally done via the Timesheet Entry screen, or timesheets can also be imported.

7.1. Details Tab

The maintain employees maintenance function is used to create a register of all Employees against which you wish to record labour costs.

![]()

Employee number: This is for reporting, and is not used by the Payroll Extract function. When importing employees, each record needs a unique number for this field, and is used for duplicate checking.

Payroll reference: This is where you should identify the employee’s Payroll reference number, and is used by the Payroll Extract function to identify the employee to Sage Payroll.

Team: Employees are linked to a team (as defined in Maintain Teams) which will link through to Sicon Service to schedule service cases. Multiple employees can be added to a team. When you select the team, you are prompted to copy through any of the work pattern, default project header, and any cost/charge/pay rates from the team onto this employee record.

Team Leader: Each team can have a single team leader. Employees enabled as Team Leaders are able to create transactions on timesheets submitted through the Sicon WAP Module on behalf of the other employees in the same team.

Sage user: This field is only applicable when used in conjunction with the Sicon Service module, and allows you to associate an employee with a Sage login, which is relevant when assigning cases to Sage users. Please see the Service documentation for further information.

Start Date: This field can be used to record the start date of the employee’s employment.

Leaver: If the employee no longer works for the company, then they can be marked as leavers instead of deleting them. This will exclude the employee from the selection list in other screens.

Charge Work Pattern: If the employee’s charge rate should be picked up from a charge rate work pattern, then it can be selected here. Charge work patterns are defined within the Maintain Work Patterns screen.

Project Manager: If ticked the employee will be available for selection a Project Manager when creating/amending a project.

Cost Work Pattern: If the employee’s cost rate should be picked up from a cost rate work pattern, then it can be selected here. Cost work patterns are defined within the Maintain Work Patterns screen.

Shop Floor User: Whether this employee is a user within the Sicon Shop Floor Data Capture application.

Subcontractor: This check box identifies the employee as a subcontractor, which is relevant if using the Self Bill Invoices screen. Once this is selected, you can then select the relevant purchase ledger account in the additional fields that appear.

Dormant: Tick this box if this Subcontractor is no longer being used. (Only appears with Sub contractor ticked)

PIN: Used by the Shop Floor Data Capture application to allow access for this employee.

Contract Expiry: This date can be used for reporting and also used in conjunction with Sicon WAP Timesheets Module to advise and/or prevent timesheets being submitted when the contract is due to or has expired.

Code/Short name/Postcode: Used to select which purchase ledger account is relevant for this Subcontractor, and required for Self Billing. (Only appears with Subcontractor ticked)

Next self bill no: Allows you to set the next reference number to be used for this sub-contractor when using the Self Bill Invoices screen. (Only appears with Subcontractor ticked)

Project Header: If required a default project header can be selected for the employees/resource costs. e.g. Labour, Subcontract (as set up in Maintain Project Headers.

7.2. Contact Details Line

This tab can be used to store the contact information of the employees. If using the Sicon Service Module, then the email address stored here will be used to notify employees of scheduled appointments etc.

![]()

7.3. Cost/Charge/Pay Rates/Self Billing Hourly Rates (Subcontractors only) Tabs

Rates are set per Employee. Cost Rates are used to account for Labour costs on a project while Charge Rates can be entered to be able to bill labour on a Service Manager Case. Pay Rates are for information purposes, and are not used when exporting information into Sage Payroll (although they can be imported from Sage Payroll, see the section regarding the Labour tab in Project Costing Settings).

The Rate Description can be changed from Rate 1, 2, 3 etc. to a free text label in accordance you’re your organisation’s requirements (within Sicon Project Settings – Rate Descriptions). You can define up to 100 different rate descriptions.

Against each cost rate, you can specify a default nominal account (including Cost Centre and Department) to act as an override. The Available on Timesheets tick box will control which cost rates can be selected on timesheet entries for that employee (either via the Timesheet Entry All Users screen, or the separate Sicon WAP application where that is being used). Cost and Charge Rates can be entered as either Hourly or Daily figures in the relevant columns.

![]()

If the employee is marked as a subcontractor, then the Pay Rates tab changes to the Self Billing Hourly Rates tab, where you can specify the rates to be applied to the Self Bill invoices for that employee. If you instead want to set a fixed monthly rate, then these are set on the Self Billing Rules tab.

For further information on generating invoices, please refer to Transaction Entry – Self Bill Invoices.

7.4. Other Tab

Five configurable fields may be displayed on the ‘Other’ tab and can be relabelled as required (Sicon Project Settings – Definitions).

![]()

7.5. Qualifications Tab

Within this tab you can record qualification information against the employee, with an expiry date recordable against each qualification, which appears in green if this date has not yet been reached and red once it has expired.

The qualifications that can be recorded are defined within the Maintain Qualifications screen in the Maintenance menu.

![]()

7.6. Linked Plant Tab

This tab will list any internal plant records that have been linked to this employee. These are setup in the Maintain Plant screen within the Owned Plant folder in the Plant section of the menu.

![]()

7.7. Memo Tab

This tab stores memos entered against this employee. Memos entered are date and time stamped, and the user is also recorded. If there are memos recorded against the employee, then the number of them will appear within the tab heading (e.g. Memo (1))

![]()

7.8. Attachments Tab

As elsewhere in Sage, you can add document attachments via this tab onto the project, either individually or an entire folder at a time. Alternatively, you can add a shortcut to an existing folder on your network.

![]()

7.9. History Tab

This tab will display an audit trail of changes made to this employee. These history records are also date and time stamped, and record the relevant user name.

![]()

7.10. Service Manager Tab

If Sicon Service is installed, an additional tab will be available for each Employee. Please refer to the Sicon Service Help and User Guide for further information.

![]()

Diary Row Colour: Select individual colours per employee to display on the Service Scheduler/Diary.

Warehouse: Link the employee with either a site based service warehouse or to individual warehouses which relate to their van/vehicle. Parts can then be transferred and allocated to engineers via their warehouse.

Billing Alias: If you do not want the employee’s name to appear on Sales Orders when billing cases, an alias can be recorded here which will then appear within the description on the sales order line.

Postcode Areas: To assist when scheduling employees to cases.

7.11. Self Billing Rules Tab (Subcontractor Employees)

When an Employee is marked as a Subcontractor, the Pay Rates Tab becomes Self Billing Rates and an additional tab appears for Self-Billing Rules.

Rates for hourly self-billing can be set on the Self Billing Rates tab, and fixed rates set on the Self Billing Rules tab. To set a Fixed Monthly rate, tick the box on the left for the relevant rate name and then you can amend the Rate column to enter that rate.

For further information on generating invoices, please refer to Transaction Entry – Self Bill Invoices.

![]()

8. Maintenance Menu | Other Screens

This menu allows access to the various maintenance functions for the Projects module.

8.1. Maintain Budgets

The system allows maintenance of budgets by project, with budgets being split at a project header level. Budgets can also be tracked at a Phases, Stages and Activities level, although you cannot set a budget at a level that has further levels defined within it. So, if you have a Phase with no Stages or Activities, then you can set budgets at that level. However, if there were Stages and/or Activities within that Phase, then the budgets need setting at the lowest level possible. To clarify, if you already have a budget set for a particular project header at an activity level, you cannot then add another budget for the same project header at a higher level (but would be fine on other activities).

After choosing the relevant project from the list of live projects, you will be presented with the following screen.

![]()

Budgets for project headers should be added as required, and can be entered as a total or by period, if enabled in Sicon Project Settings you can also record hours and an hourly rate as a budget. If recording the Budget by Period, then the total budget will be stored against the Project Header and the Phase/Stage/Activity if enabled. In the example below, a Budget against period 12 (2018) and period 1 (2019) will store as a total of both against the project. If using Budgeted Hours and Hours Rate against the Labour Project Header Type, when saving the Budget by Period the system will prompt to convert this into Hours based on the Rate.

![]()

Tabs for Costs and Revenue allow you to update those budgets on separate screens.

You will see the budgets displayed in an expanded view for the Phases/Stages/Activities that you have recorded budgets against (assuming you have these enabled in the Sicon Project Settings). You can view them at purely a project header level by changing the radio button near the top of the window to the ‘By Project Header’ option – but you’ll only be able to view them in that screen, you’ll need to add and edit them in the ‘By Phases & Stages’ view.

The View Project Enquiry button may be clicked to display the project enquiry screen for the selected project .

When editing budgets that relate to project headers that have a project header type of labour, an Hours Rate field is available where you can enter a default hourly rate that can then be used to generate the either the Budget amount or Budget hours fields (depending upon which one you populate first). A prompt appears asking if you would like to update the relevant field as soon as you edit the other one.

![]()

If you have any planned purchases on this project, then their costs will appear within the Planned column against the project header selected when entering the planned purchases. These costs will then move to the committed and actual columns (as appropriate) as the purchase order is generated and processed.

8.2. Maintain Cost at Completion

This screen enables you to review and enter the expected remaining costs on a project, and then track them on a period/weekly basis. The setting as to which you are using is found on the Other tab of Sicon Project settings. You can track back through previous periods to review when forecasted costs were amended to review the forecasts through the life of the project.

If you are using Phases/Stages/Activities within the relevant project, then the costs to complete are tracked against each activity. It is possible to record Costs at Completion at the top level of the project by not selecting any phases/stages/activities, but this will be a separate cost at completion option, so would not include anything recorded at a lower level.

If you do have multiple costs to complete screens populated on the same project (usually because you have multiple activities), then you can review the total forecasted situation via the Project Summary tab within the Project Enquiry screen.

![]()

Select the project number in the filter at the top of the window, and then select the Period that you wish to update. To the right of the date, the status of that period from Accounting Periods will be displayed (e.g. Open, Future etc.). The Project percentage complete is then displayed, this is maintained on the project itself. On the Cost at Completion form you can also maintain a completion profile which you can record an expected percentage complete on a period basis. This will update the Project percentage complete within the Cost at Completion form.

![]()

For each cost type project header, you will see the budget value (if one has been entered via Maintain Budgets) and the costs split into Actual costs, Committed costs and Total costs.

The Cost to Completion and Hours to Completion columns (if relevant) would then be updated by the relevant users (i.e. Project Managers) with the expected remaining costs for the project. These would then be added to the existing costs to update the Revised Forecast Cost to Complete for that project Header. A variance is then displayed between this total and the current budget figure, showing in green for a positive variance, and red for a negative one. After amending the Cost at Completion, you must enter a reason for the change in the final column. This reason must be a minimum of 5 characters long, and can be free text although you can define the reasons in the drop down via the Reasons For Change screen.

You can use the Set to Budget button to set all of the Cost at Completion values to the value that would keep you at the budget level. The Set to Previous button would be used to copy the previous month’s cost to complete values across to the current month (i.e. if there had been no movement on this project). The View Transactions button will display all transactions on the project that fall into the currently selected period.

The Accrual column can be used to generate a Cost at Completion Accrual Journal in the Period End Routines. The figure shown is calculated based on the Project percentage complete of the Revised Forecast Cost at Completion minus the Actual Costs (((Revised/100)*%Complete)-Actual).

![]()

Once the journal has been generated using this routine, the Project Header line will be marked as Accrued (Accrual Posted Column).

8.3. Maintain Revenue at Completion

This screen works in an identical fashion to the Maintain Cost at Completion but provides you with a mechanism for tracking project revenue on a monthly basis. The project headers displayed on this screen would be ones that are of type ‘revenue’.

![]()

The Accrual for the Revenue at Completion can be generated using the Revenue at Completion Accrual in the Period End Routines .

8.4. Maintain Phases, Stages & Activities

This screen is where you define the phases, stages and activities that are then available in the Phases/Stages tab of New Project and Amend Project, if you have enabled these levels in Sicon Project Settings . This is not necessarily required, as free text descriptions can be added for these elements when amending a project.

It is also possible to maintain a list of statuses that can then be applied to the phases, stages and activities within the Amend Project screen. These statuses would then be visible (in brackets) when linking a transaction to the appropriate phase/stage/activity. Note that it is not possible to remove the status of Completed, as this is a system specified status.

![]()

8.5. Project Rates

This screen allows you to set up employee rates for individual projects. These rates will override any standard rates for any employee rates when working in the related project. You are able to add lines for each employee to cover:

- Cost – The amount incurred by an employee when working for a period of time on an a project

- Charge – The value that the employee will be used to raise for billing

- Pay – The rate that the employee will be paid (NOTE: This will only be used in Sage payroll is being used)

When the screen is displayed with all employees who have project rates set, the below is an example:

![]()

You can use the filters at the top to refine your search and you are able to search by:

- Employee

- Project

- Project Header

- Rate

- Rate Type

- The selections can be:

- All

- Cost

- Charge

- Pay

- The selections can be:

The filters can be used individually or in combination,

![]()

New lines can be added by clicking the Add button, you are then able to enter the relevant details for each employee required.

To change any details already entered for an employee you would double click on the relevant line or select the line and click the Edit button. The following window will be displayed:

![]()

Note that only the hourly rate can be changed. If you wish to amend any other details the line will need to be deleted and a new one added. A line can be removed by selecting the line you need to clear and clicking the remove button

You can import Project rates using the Import Project rates menu option, please see the Import Section of this Help and User Guide.

Note: At this time Sicon Service does not integrate / use this functionality

8.6. Maintain Custom Tabs

This is where you can create and amend custom tabs that you want to appear in the Create Project and Amend Project screens. Once defined, custom fields are allocated to the tabs via the Define Custom Fields screen.

![]()

8.7. Define Custom Fields

This screen is used to define which of the 140 custom fields are in use, and which of the custom tabs they appear on in the Create Project/Amend Project screens. The fields are split into separate field types: –

Boolean: A tick box

DateTime: A date field

Numeric: A number field

String: A text field

![]()

Select the fields that you want to use from the Non Active Fields on the left hand side based on the type of field. You can then enter a Display Name, tick if it should be a mandatory field and select which tab it should appear on from those defined in Maintain Custom Tabs. You can use the Move Up and Move Down buttons to change the order in which the fields are displayed.

The Field Length field can be changed to reflect the number of decimal places that you would like a numeric field to go to. Leaving this set to zero will result in only whole numbers being stored in these fields.

8.8. Maintain Qualifications

This screen allows you to define the list of qualifications, which are available for selection on the Qualfications tab of the Maintain Employee screen.

![]()

8.9. Maintain Teams

This screen enables you to maintain the teams, which are then selectable against each Employee record in the Maintain Employees screen.

You can specify a charge work pattern and a cost work pattern as well as a default project header. These are then used when you are creating new employee records; once you have selected the team on the new employee record, it will then prompt you if you want to populate the same fields on that employee with the values defined on the team. In a similar fashion, the fields on the other tabs also work like a template.

Note that changing any of these fields will not update existing employee records.

![]()

8.10. Maintain Work Patterns

This enables you to define work patterns, which allow you to specify either times or number of hours that an employee works before entries would be assigned to a different project costing rate.

Note that this functionality only works with either the Sicon Service Module or the Sicon Manufacturing Suite. Labour entries entered either via the Timesheet Entry screen or the Miscellaneous and Labour screen will require you to select the relevant project costing rate, they do not currently adjust these entries to reflect the work patterns.

Work Patterns are defined as either being applicable for costs, or charge out rates, but not for both. If you are planning on using work patterns, you will need a minimum of two – one cost work pattern and one charge work pattern.

![]()

You can define as many work patterns as required. You cannot delete work patterns that are currently in use against employees or teams.

![]()

Against each work pattern, you can select whether it is a Cost Rate type, or a Charge Rate type.

Entries in this screen are entered either via Hours, or Time. This can be chosen via the radio button to the right of the Rate Type drop down.

If using time, you can add as many Project Costing rate lines as needed, and then against each day of the week record the times that apply for that rate. E.g. If an employee worked a weekday from 4pm to 7pm on the pattern defined in the screenshot, he would count as 1 hour at Normal rate, and 2 hours at Overtime.

![]()

If using the number of hours, then you enter the number of hours that an employee would work at the first work pattern, before any extra time would move onto the subsequent project costing rates.

In the example in the above screenshot, the first 5 hours that an employee worked on a weekday would be considered as Normal project rate, while the next 2 hours would be Overtime, with up to 2 hours beyond that being considered at the higher Weekend rate (which also applies to up to 9 hours worked on Saturdays or Sundays).

8.11. Maintain Timesheets Location

![]()

This screen allows you to maintain Location names that are then used for the Sicon WAP Timesheets application, as valid locations that employees can use when recording their timesheets. Each location can have a friendly name recorded against it in addition to the Location Name, and this friendly name is what is then displayed for the end users, but the Location Name could be used for reporting if desired.

8.12. Maintain Timesheet Leaving Reasons

![]()

This screen allows you to maintain leaving reasons that are then used for the Sicon WAP Timesheets application, as valid reasons that users can select when clocking out of the system. As with the timesheet locations, it is possible to define a separate friendly name for a leaving reason, which is what will be displayed for the users.

8.13. Risk Assessments and Mission Statements

![]()

This screen is where you can enter your RAM Statements that can then be added to projects via the RAMS tab in the Amend project screen.

8.14. Reasons for Change

![]()

This screen is where you can maintain valid reasons for change, which will then be used on the Cost at Completion and Revenue at Completion screens.

8.15. Analysis Codes

![]()

This screen is where you can maintain the seven analysis codes that appear on the General tab of a project. For each analysis code that you wish to use (selectable via the tick box to the left of the code label), you can rename the label, select whether it is mandatory, and then choose the data type from the following options: –

- Text

- Date

- Drop-Down List (which is then maintainable via ellipsis next to the data type)

- Numeric Value

- Tick Box

The analysis codes specified here are selectable as columns on the Project lists. If you rename the labels and wish them to appear in the Project list you will need to Reset Desktop Settings with the Sage preferences menu.

8.16. Maintain Supplier Catalogue

![]()

This screen is used for situations where you want to maintain a list of the items that you can buy from a supplier, but that are not setup as stock codes in your Sage 200 Stock Control module. You can define them via this screen, and then when creating a line on a purchase order, you can select an item from this catalogue. These lines will then be free text lines, so ordering the item does not mean that it is created as a stock code within your system.

You can use the search filters at the top of the window to search this catalogue for entries. Although the entries are not actual stock codes, you can still assign one to an existing Sage product group for the purposes of this catalogue, and then use that filter to help find them again. Alternatively, you can search this catalogue directly via the Catalogue Item Search field.

New entries into the catalogue can be input via the Add Item button, or can be imported via the Import button.

![]()

When manually entering a new catalogue entry, you can give it a code and a name, select from the existing Sage product groups and give it a default tax code. You can enter a buying price and buying unit description, and enter a Nominal code and choose the relevant supplier code. Finally, there is an item description field that is larger than the Name field.

Alternatively, you can import the catalogue entries: –

![]()

This screen enables you to import the items for the catalogue from a csv file. As with other Sicon imports, you can use the Example Import File button to generate both an example Excel file, and a second file that explains the columns and confirms which ones are compulsory. If you use the example Excel file, you will need to save it as a csv file prior to import.

Prior to importing the file, you will need to click the Check File button to validate the import file, and then the Details section of the window will display the records in your file, and highlight any errors. Once a file has been successfully checked, then you will be able to use the Import button to perform the import.

8.17. Bank Holidays

![]()

This screen allows you to maintain the list of bank holidays. Currently, these do not update anything on timesheet entries, but will in a future version of the product when used in conjunction with work patterns.

You can enter multiple groups of bank holidays, such as entering them for different countries. If you click the Set UK defaults button, then it will automatically insert/reset all UK bank holidays for the next 10 years.

![]()

9. Transaction Entry Menu

The Project Journal screen allows corrections to be posted to a project by moving costs to a different project.

The Complete Projects screen can be used to quickly complete several projects.

The Rapid Stock Issue screen can be used to issue multiple stock items to a selected project.

The Self Bill Invoices screen can be used to generate purchase ledger transactions from subcontractor labour transactions.

The Generate Billing Transactions screen can be used to generate sales orders for invoicing the customer on the project for transactions in the system.

The Timesheet Entry screen can be used for recording timesheets into Project Costing.

The Post Timesheet Journals screen enables you to quickly post a nominal journal for the cost of the selected timesheet entries, if you need a corresponding posting in your Nominal ledger.

The Amend Timesheet Clock In Lines screen enables you to amend timesheet information that has been recorded in either the Sicon WAP Timesheets application or the Sicon Shop Floor Data Capture mobile app.

The Maintain Billed Transactions screen works in conjunction with the Generate Billing Transactions screen, and allows you to mark transactions as billed (without billing them), or unmark previously billed transactions if you would then want to bill them again.

9.1. Project Journal

The Project Journal screen opens the Sage Create Nominal Journal entry screen to allow you to correct transactions that have been coded to the wrong project or project header whilst also posting a nominal journal. Alternatively, you may just want to post a nominal journal that is reflected within Sicon Projects. As with regular nominal journals, it must balance before you are able to save and apply the journal. You can split a figure across multiple projects and/or project headers as desired.

![]()

If you do not want to change any balances in your nominal ledger as a result of a correction to project transactions, then you could code all debits and credits to the same nominal account. If you do not want these transactions appearing in nominal accounts that you may be checking for other purposes, then it is recommended that you create a specific nominal account purely for this purpose. Its balance will remain at zero.

If you are correcting existing transactions, then you may want to consider using the Transaction Editor within the Utilities menu.

9.2. Complete Projects

This screen may be used to automatically set the ‘percentage complete’ on a project to 100%; effectively flagging it as ‘complete’.

To flag a project as complete check the tick-box and accept the change when the confirmation message is displayed. The screen will prompt you to enter an Actual Completion Date.

![]()

9.3. Rapid Stock Issue

This screen may be used to quickly issue stock (using ‘Internal Issue’ stock movements) to multiple projects in a batch environment.

Simply add transactions to the list and then click the Post button to process the transactions. The internal area used for the stock issue is set on the Stock tab of Sicon Project Settings.

![]()

Clicking on the Edit Line button, allows you to add more details to the Rapid Issue Line, such as changing the Internal area from the default set in Project Settings or adding an Employee link to the stock issue line.

![]()

9.4. Self Bill Invoices

This screen generates Purchase Ledger invoices for selected sub-contractor transactions. (For employee set up, see Maintain Employees – Self Billing). Once an employee has been marked as being a subcontractor (with the relevant supplier account selected against them), then their timesheet entries will become available here for self-billing.

In the following examples the employee will be self-billed on one invoice for the hours recorded as Hourly. If the employee had been set with any Self Billing Rules which applied to this job rate, then these would be billed as a fixed monthly rate regardless of the entries. In this case, you could use the View Timesheet Lines button to see which timesheet entries are being billed as part of that entry. Note that it is possible to bill against the same fixed monthly rate multiple times, especially if you are invoicing weekly, so care should be taken to ensure this happens once per month, otherwise you could end up with multiple monthly invoices on the account to pay for the same subcontractor.

The lines can be individually selected if appropriate, the invoice date can be changed if required and if Invoice Authorisation is enabled in the Purchase Ledger settings, there is the function to allow this to be disabled for that particular invoice.

![]()

The nominal code for the posted invoices will come from the project header, unless overridden by the combination of project header and project.

A document is generated off the back of this process and self-billing invoices can be stored within the Sicon Documents Module if you are using that module.

9.5. Generate Billing Transactions

This screen is used when you wish to bill the customer for Costs e.g. billing on a supplier invoice to the project customer, that are linked to the project.

The filters at the top of the window can be used to refine the transactions by project, customer, project header, transaction date range, employee (for labour transactions), transaction type (e.g. LABOUR or STOCK) and lastly a check box to include transactions that have been set as Non-Chargeable for the relevant project.

When creating/amending the project, there is a field on the General tab called Chargeable Type where you can specify whether all transactions are chargeable or non-chargeable, or just labour or just materials are non-chargeable.

On the project you can specify the Markup percentage to apply to chargeable transactions., This can also be set on the Project Headers tab to specify different markup percentages for individual project headers.

Default Markup percentages can be configured against project headers in the Maintain Project Headers screen.

Markup percentage set at project level override any set at project header level.

When using generate billing transactions for employees (and subcontractors set up as employees) this will use the charge rate linked to the employee record in maintain employees.

Subcontractor invoices that are to be billed on to the project customer using generate billing transactions will use any markup percentages that have been set.

Stock billed in this way will only use the mark up percentage if there is no selling price for the stock item. Where there is no selling price, the system will use Cost Price + Markup to make the calculation.

Select the transactions that you would like to bill. A sales order will be generated for each customer selected (you will also be prompted to add the lines to an existing open sales order if one exists). Note that if you select the Group Transactions checkbox, then the transactions will be grouped together within the same sales order line.

![]()

Any transactions that are on a project that do not have a customer linked to it are highlighted in red.

If there are transactions appearing that need to be marked as non-chargeable, then you can do this via the Change Chargeable Type button.

After selecting the transactions that you wish to bill and clicking the Generate button, the Confirm Billing Order Lines window is displayed. If you have an existing open Sales Order you are asked if you would like to add these transactions to it. If choosing yes, you will need to select the Sales Order you would like to update, else you will move to the confirm Billing Order Lines screen.

![]()

![]()

In this window, you can choose whether you wish the employee name to be included in the line description, and whether you want to convert the hours to days (using the Default Working Day Hours setting within the Sicon Project settings Labour tab).

You can also edit the Promised Date, Quantity, Unit Value and Line Description fields if desired. When ready click the Confirm button, and then the sales order will be created, or updated if adding to an existing sales order.

Billing Profile can be set to allow for agreed prices to be configured for the project.

From the amend project screen select the billing profile tab. This is used where you have quotes costs for various stages of a project and the customer has agreed the values and they are not to be exceeded.

Click Add New to enter the lines as required – the example below is for foundations, initial build, first fix and second fix.

![]()

Each line has its own Fixed Cost price and expiry date (the date you expect the work to be completed by).

The status is Open as they are newly created profiles and are unbilled.

They can be linked (if using) to phases, stages and activities.

Click save when completed.

As the project is to be billed using the generate Billing Transactions, search for the project number and you will get an additional dialog box in order to use the billing profile.

![]()

OK the message above to select the billing profile to be used for this transaction.